The paper titled "A central limit theorem, loss aversion and multi-armed bandits" collaborated by Prof. Zengjing Chen, internationally renowned economist Larry G. Epstein and Dr. Guodong Zhang was published in Journal of Economic Theory (Volume 209, April 2023), one of the top journals in the field of theoretical economics. An explicit expression for the density function of nonlinear normal distribution was obtained, which was firstly found since mathematicians represented by De Moivre and Gauss discovered linear normal distribution (also known as Gaussian distribution).

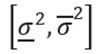

It has always been a trending topic for nonlinear limit theorem researchers to explore explicit expressions of nonlinear limit distribution in the field of economics and reinforcement learning. The analysis in this paper is based on a new central limit theorem (CLT) for a set of probability measures under which conditional variances can vary with a constant conditional mean of a sequence of random variables and subject only to the restriction that they lie in a fixed interval:

.

.

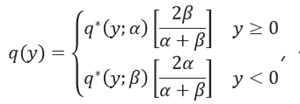

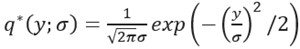

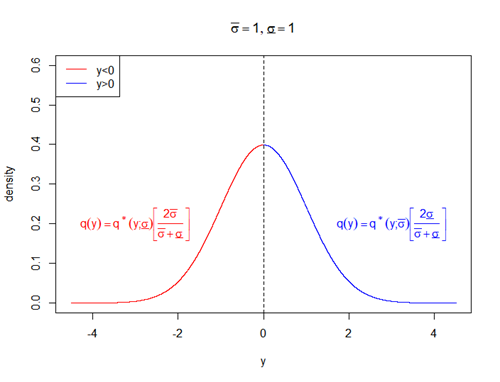

Under these preliminaries, the team got to prove that its limit distribution is a class of mean-invariant nonlinear normal distributions with an explicit probability density function of the following form:

where

is the probability density function for the normal distribution  . The values of the coefficients α and β rely on both

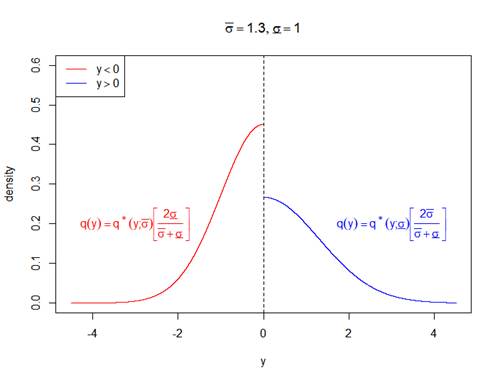

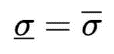

. The values of the coefficients α and β rely on both  and the concavity of the utility function. (The probability density of the function is shown below.)

and the concavity of the utility function. (The probability density of the function is shown below.)

Specifically, the nonlinear normal distribution reduces to the normal distribution if  .

.

Based on the limit theorem, this paper further investigates the asymptotically optimal strategy for the decision-maker with loss aversion in the multi-armed bandit problem, which is initially found in this field. Loss aversion is a well-established concept introduced via cumulative prospect theory in behavioral economics by Daniel Kahneman, who won the Nobel Prize in Economic Sciences, and Amos Tversky, a member of the National Academy of Sciences. The "S-shaped" utility function is an important index in the research, through which the team found the asymptotic optimality of the decision-maker's cumulative gains and managed to give an asymptotically optimal strategy based on the above limit theorem to achieve maximum expected utility.

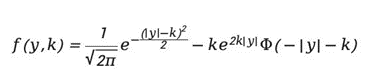

On the other hand, a CLT for a set of probability measures with mean uncertainty was discovered in the article "A central limit theorem for sets of probability measures" published in Stochastic Processes and their Applications by Prof. Zengjing Chen and Prof. Larry Epstein. Under the assumption that the conditional variance of a set of random variables is certain and the conditional mean vary in a fixed interval  , its limit distribution is proved to be a class of variance-invariant nonlinear normal distributions with an explicit probability density function of the following form:

, its limit distribution is proved to be a class of variance-invariant nonlinear normal distributions with an explicit probability density function of the following form:

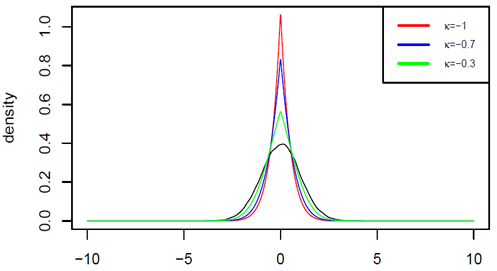

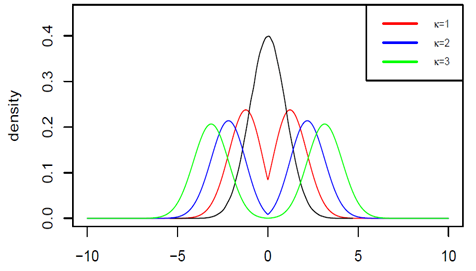

where Φ is a standard normal distribution function. The value of the coefficient k depends on  and the monotonicity of the utility function. When k < 0, the nonlinear normal distribution is needle-like (Figure 1); when k > 0, the nonlinear normal distribution is in the form of bimodal distribution (Figure 2); and when k = 0, it degenerates into a classical normal distribution.

and the monotonicity of the utility function. When k < 0, the nonlinear normal distribution is needle-like (Figure 1); when k > 0, the nonlinear normal distribution is in the form of bimodal distribution (Figure 2); and when k = 0, it degenerates into a classical normal distribution.

Figure 1

Figure 2

The discovery further developed related theories about the asset pricing formula for incomplete markets and provided theoretical foundation for the analog computation and practical application of the formula.

So far, Prof. Zengjing Chen and his team have found a series of nonlinear central limit theorems in terms of both mean uncertainty and variance uncertainty, particularly giving out explicit expressions for limit distributions of certain significant functions in the fields of economics and statistics, such as "S-shaped" function, characteristic function and so on. The research results not only further enhance the nonlinear expectation limit theory, but provide a theoretical basis for addressing practical matters in economics, finance, mathematical statistics and reinforcement learning under uncertain environments.

Founded in 1969, Journal of Economic Theory is the most highly-regarded international journal in the field of theoretical economics. It should also be noted that Prof. Zengjing Chen is the first Chinese scholar to publish articles on Econometrica, which is the journal of the Econometric Society and is deemed one of the top journals in the field of economics along with American Economic Review, Quarterly Journal of Economics, Journal of Political Economy and Review of Economic Studies.

Reference: https://doi.org/10.1016/j.jet.2023.105645

微信公众号

微信公众号